Credit card from MTS Bank

Receiving a loan requires a borrower of certain costs of time to visit the Bank's branch, collecting documents and consideration of the next application. It is much more convenient to use credit funds at once as soon as there is a need for them.

The credit card manufactured by MTS Bank allows you to solve this problem, providing your owner a financial pillow for a black day. Consider a Read more new banking product, the complete name of which sounds as follows: MTS credit card.

What does MTS card look like? One of the options.

Features MTS card

MTS credit card Money allows you to make purchases of interest to the total amount of the check up to 300 thousand rubles. Its key feature is from each transaction will be returned to the balance of your mobile phone. Thus, when using the maximum possible limit on your SIM card, 6000 rubles will additionally appear, which can be spent on communication services or bring to the card with the payment of a small commission.

You can make purchases for money MTS Bank for free if you return funds to the card account on time. The borrower is provided until 51 days on debt repayment. And MTS subscribers do not pay MTS bank for maintaining MTS credit card money in the first year after design.

Pros and cons of credit card from MTS

The main advantage of the MTS Bank credit card is the maximum simplified procedure for obtaining it. The client does not require confirmation of income and other references. It is enough to present only a passport of a citizen of the Russian Federation. The whole procedure takes no more than half an hour, and here you have an active card on your hands.

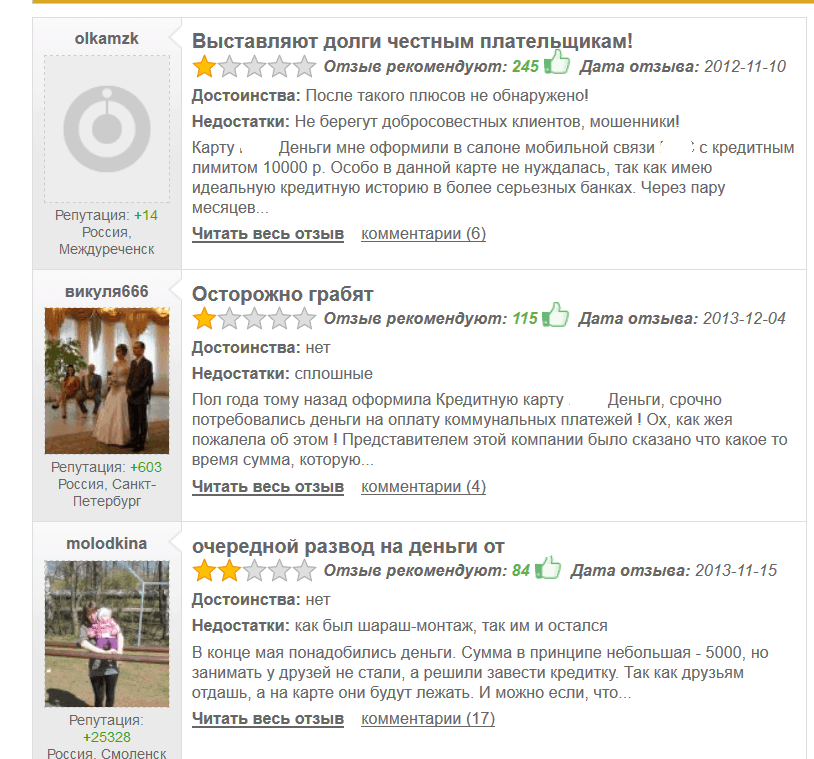

Unfortunately, the reviews on the Internet are predominantly negative. In particular, former and existing clients complain about serious shortcomings in cooperation with MTS Bank:

- Instant removal of funds for the use of the loan, SMS-informing, insurance and other services. Thus, immediately after receiving the map, the client is already in the status of the debtor.

- In most cases, the provided credit limit of tens of times is inferior to the declared in advertising. Most often, the limit on the card does not exceed 5-10 thousand rubles, of which about 1000 rubles will already be charged for banking services.

- The increase in the maximum amount permissible to the removal occurs without coordination with the card owner. This leads to new problems, since the increase in the limit is accompanied by an increase in interest rate.

- No trading network is cooperating with MTS Bank, because of which it is possible to return funds to the card only in its own communication salon or the MTS Bank branch.

- With any delay in payment, your debt is sold to unscrupulous collection agencies, whose specialists resort to regular concern for the relatives of the borrower, threats in his address and other illegal activities.

MTS Money allows you to get a loan from the bank in cash. However, it is possible to remove even own funds without commission only in ATMs:

MTS Money allows you to get a loan from the bank in cash. However, it is possible to remove even own funds without commission only in ATMs:

- PJSC MTS Bank.

- PJSC Sberbank.

- PJSC "VTB 24".

In all other cases, there will be a debt from the balance of cash fees. Card replenishment is possible only through MTS communication salons, MTS Bank offices and payment terminals Eleksnet.

Documents for obtaining a loan from MTS

If you are a MTS subscriber and want to provide you with cash loan, be prepared to spend some time collecting documents. The main banking product - the consumer loan is issued in two documents, the first of which must be passport of a citizen of the Russian Federation, as a second one can present international passport, driving license, insurance certificate of the FIU. The maximum amount of lending is 100,000 rubles.

How to issue MTS Bank, credit

At the time of writing, the reviews on the Internet about the experience of working with this card were predominantly negative. Perhaps it is due to part incl. Invulsion to use similar suggestions and insufficient user awareness cards about all product use rules.

If you still want to get a MTS credit card or make a loan, you should go to the site http://mtsbank.ru and explore the conditions in the "Consumer Loans" section (for salary clients of MTS Bank, for existing or former MTS Bank borrowers, for MTS subscribers) or "Credit Cards".

Online application for mapping MTS Money

![]()

How to get a MTS card money after credit approval?

After mTS Bank analysts will verify the information provided and will make a positive decision on opening a credit line, a bank employee will contact the borrower with a borrower. Together with the client, a specialist will determine the optimal sales salon of MTS or the MTS Bank office, where the MTS credit card will be sent.

To pick up the card, the client needs to appear in the appropriate division with the passport. The handling procedure will take no more than ten minutes. You can remove the cash immediately after receiving the map.